Licencia de seguros en florida – Embark on a journey into the realm of insurance licensing in Florida, where knowledge empowers you to navigate the industry’s intricacies. This comprehensive guide will equip you with the insights and guidance you need to obtain your license, expand your career opportunities, and safeguard your clients’ financial well-being.

From eligibility criteria to examination details, continuing education requirements to disciplinary actions, we delve into every aspect of insurance licensing, ensuring you possess the expertise to excel in this dynamic field.

Licensing Requirements

Obtaining an insurance license in Florida requires meeting specific eligibility criteria, including education, experience, and passing an examination.

To be eligible for an insurance license, you must:

- Be at least 18 years of age.

- Have a high school diploma or equivalent.

- Complete pre-licensing education courses.

- Pass a state insurance licensing exam.

- Meet any additional requirements specific to the type of license you are seeking.

Education Requirements

The Florida Department of Insurance requires you to complete pre-licensing education courses before taking the licensing exam. The number of hours required varies depending on the type of license you are seeking. For example, a 20-hour pre-licensing course is required for a life insurance license, while a 40-hour course is required for a property and casualty insurance license.

Examination Requirements

Once you have completed the pre-licensing education requirements, you must pass a state insurance licensing exam. The exam is administered by Pearson VUE and covers topics such as insurance laws, regulations, and products.

Getting a licencia de seguros en florida is essential for insurance professionals in the state. If you’re interested in learning more about which tile is missing caliper, there’s a comprehensive guide available here . Returning to the topic of licencia de seguros en florida, obtaining the license involves passing a state exam and meeting specific education requirements.

Continuing Education and Renewal

Insurance licenses in Florida must be renewed every two years. To renew your license, you must complete continuing education courses. The number of hours required varies depending on the type of license you hold. For example, 15 hours of continuing education are required for a life insurance license, while 24 hours are required for a property and casualty insurance license.

License Types and Classifications

Florida offers various insurance licenses to meet the diverse needs of the industry. Each license type has its own scope of practice and limitations, ensuring that insurance professionals operate within their designated areas of expertise.

Property and Casualty Insurance Licenses

Property and casualty insurance licenses cover a wide range of insurance products, including homeowners, renters, auto, and commercial property insurance. These licenses are classified into:

- Personal Lines Agent:Authorizes the sale of personal insurance products, such as homeowners and auto insurance.

- Commercial Lines Agent:Permits the sale of commercial insurance products, such as property and liability insurance for businesses.

- Property and Casualty Adjuster:Allows individuals to investigate and settle claims related to property and casualty insurance.

Application Process: Licencia De Seguros En Florida

Applying for an insurance license in Florida is a straightforward process. Here’s a step-by-step guide: Step 1: Determine License TypeIdentify the specific insurance license you need based on the type of insurance you plan to sell. Step 2: Complete Application FormVisit the Florida Department of Insurance (FDOI) website to download the application form.

Fill out the form accurately and completely. Step 3: Submit Application and FeeSubmit the completed application along with the required fee to the FDOI. You can submit your application online, by mail, or in person at an FDOI office. Step 4: Pre-Licensing EducationComplete the required pre-licensing education courses for the specific license type.

The courses can be taken online or in person. Step 5: ExamTake and pass the state insurance licensing exam. You have 120 days from the date of your application to pass the exam. Step 6: License IssuanceOnce you pass the exam, the FDOI will issue your insurance license.

You will receive a license number and expiration date.

Documentation Required for Submission

Along with the application form, you will need to submit the following documents:

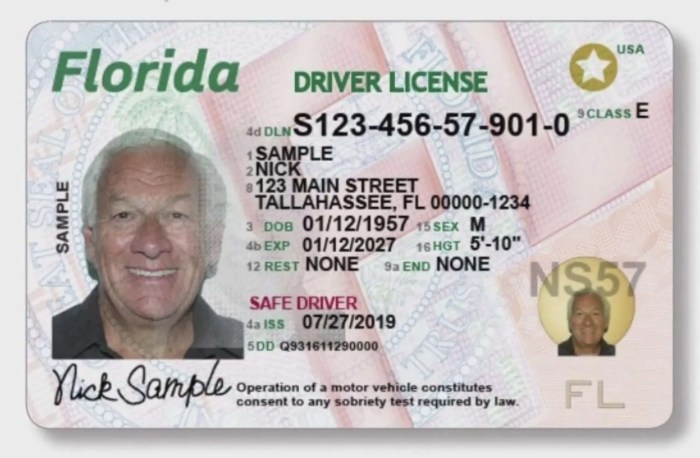

- Proof of identity (e.g., driver’s license, passport)

- Proof of address (e.g., utility bill, bank statement)

- Fingerprints for a background check

- Certificate of completion for pre-licensing education

Examination Information

The Florida insurance license examination is a crucial step in obtaining your license. The exam assesses your knowledge and understanding of insurance principles and regulations specific to Florida.

The exam format consists of multiple-choice questions covering various insurance topics. The content includes insurance laws and regulations, policy types, underwriting principles, claims handling, and ethics.

Passing Scores

To pass the exam, you must achieve a minimum score of 70%. The passing score may vary depending on the specific license type you are applying for.

Study Materials

There are numerous study materials available to help you prepare for the exam. The Florida Department of Insurance (FDOI) provides a study guide that covers the exam content. Additionally, various commercial providers offer online courses, practice tests, and study materials.

Background Checks and Fingerprinting

Before obtaining an insurance license in Florida, you must undergo a comprehensive background check and provide fingerprints for processing. These measures ensure that only qualified and trustworthy individuals are licensed to sell insurance products.

The background check process involves a thorough review of your criminal history, credit report, and any other relevant information that may impact your eligibility for an insurance license. You will be required to provide a Social Security number, driver’s license number, and other personal details.

Fingerprinting Requirements

In addition to the background check, you must also submit fingerprints to the Florida Department of Insurance (FDOI). The FDOI uses fingerprints to conduct a criminal history check through the Federal Bureau of Investigation (FBI).

You can submit your fingerprints electronically or at an authorized Live Scan fingerprinting location. The cost of fingerprinting varies depending on the method you choose.

Timelines and Costs

The background check and fingerprinting process typically takes several weeks to complete. The cost of the background check is approximately $50, while the cost of fingerprinting varies depending on the method you choose.

Fees and Costs

Obtaining an insurance license in Florida involves certain fees and costs. Understanding these expenses is crucial for proper planning and budgeting.

Application Fees

When submitting an application for an insurance license, you must pay an application fee. This fee varies depending on the type of license you are applying for.

Examination Fees

After your application is approved, you will need to take an examination to demonstrate your knowledge and understanding of insurance principles. The examination fee covers the cost of administering and grading the exam.

Renewal Fees

Insurance licenses in Florida must be renewed periodically. The renewal fee ensures that your license remains active and up-to-date.

Additional Costs

In addition to the fees mentioned above, there may be additional costs associated with obtaining an insurance license. These may include fingerprinting fees, background check fees, and continuing education expenses.

License Status and Maintenance

Ensuring the validity and accuracy of your insurance license in Florida is crucial. Here’s a comprehensive guide to license status verification, reporting changes, and maintaining an active license through continuing education and renewal.

License Status Verification

Checking the status of your insurance license is essential for compliance and to avoid any potential penalties. The Florida Department of Insurance (FDOI) provides several convenient methods for status verification:

- Online License Lookup:Visit the FDOI website to search for your license status using your name, license number, or social security number.

- Telephone Inquiry:Call the FDOI at 850-413-3155 during business hours to obtain license status information.

- Written Request:Submit a written request to the FDOI, including your name, license number, and contact information.

Reporting Changes

It’s important to promptly report any changes to your personal information or business address to the FDOI. Failure to do so may result in missed correspondence or delays in license renewal.

To report changes, you can:

- Online Change of Address:Visit the FDOI website to update your address online.

- Written Request:Submit a written request to the FDOI, including your name, license number, and updated information.

Maintaining an Active License

To maintain an active insurance license in Florida, you must fulfill continuing education requirements and renew your license on time.

Continuing Education:All licensed insurance agents must complete 24 hours of continuing education every two years. Approved courses cover topics relevant to the insurance industry and help ensure your knowledge and skills are up-to-date.

License Renewal:Insurance licenses expire every two years on the last day of your birth month. You must renew your license by completing the renewal application and paying the required fees.

Disciplinary Actions

The Florida Department of Insurance (FDOI) has the authority to take disciplinary action against insurance licensees who violate the state’s insurance laws and regulations. Disciplinary actions can range from a warning letter to suspension or revocation of the license.The grounds for disciplinary action include, but are not limited to:

- Fraud or misrepresentation

- Incompetence or untrustworthiness

- Violation of insurance laws or regulations

- Misappropriation of client funds

Disciplinary Process

When the FDOI receives a complaint against a licensee, it will investigate the allegations. If the investigation finds evidence of wrongdoing, the FDOI will initiate a disciplinary action.The licensee will be notified of the charges against them and given an opportunity to respond.

A hearing may be held to determine if the licensee is guilty of the charges.If the licensee is found guilty, the FDOI may impose a disciplinary action. The type of disciplinary action will depend on the severity of the offense.

Appeals Process

Licensees who are found guilty of disciplinary charges have the right to appeal the decision. The appeal must be filed within 30 days of the date the disciplinary action was imposed.The appeal will be heard by an administrative law judge.

The judge will review the evidence and make a decision on the appeal.

Reinstatement Options

Licensees who have had their license suspended or revoked may be eligible for reinstatement. To be eligible for reinstatement, the licensee must:

- Have served the full term of their suspension or revocation

- Complete any required continuing education courses

- Pass a new insurance license exam

- Demonstrate that they are fit to hold an insurance license

The FDOI will review the licensee’s application for reinstatement and make a decision on whether to grant the reinstatement.

Resources and Contact Information

If you have any further questions or need additional information regarding insurance licensing in Florida, there are numerous resources available to assist you.

The Florida Department of Insurance (FDI) is the primary regulatory agency responsible for licensing and overseeing insurance professionals in the state. You can contact the FDI at (850) 413-3089 or visit their website at https://www.myfloridacfo.com/ .

Other Organizations, Licencia de seguros en florida

- Florida Association of Insurance Agents (FAIA): https://www.faia.org/

- Independent Insurance Agents & Brokers of Florida (IIABF): https://www.iiabf.org/

- National Association of Insurance and Financial Advisors (NAIFA): https://www.naifa.org/

Online Resources

- FDI Licensing Information: Provides detailed information on insurance licensing requirements, license types, and the application process.

- FDI Exam Information: Offers resources for preparing for and scheduling insurance licensing exams.

- FDI License Status and Maintenance: Explains how to maintain an active insurance license and renew it when necessary.

Downloadable Materials

- Resident Lines Insurance License Requirements: Artikels the qualifications and steps required to obtain a resident lines insurance license.

- Non-Resident Lines Insurance License Requirements: Provides guidance for individuals seeking a non-resident lines insurance license.

- Lines of Authority Matrix: Lists the various lines of insurance and the licenses required to sell them in Florida.

Key Questions Answered

What are the eligibility requirements for obtaining an insurance license in Florida?

To be eligible for an insurance license in Florida, you must be at least 18 years old, have a high school diploma or equivalent, and meet the education and experience requirements specific to the license type you are seeking.

How do I apply for an insurance license in Florida?

You can apply for an insurance license in Florida through the Florida Department of Insurance’s website. The application process involves completing an application form, providing documentation, and submitting fingerprints for a background check.

What is the cost of obtaining an insurance license in Florida?

The cost of obtaining an insurance license in Florida varies depending on the license type and includes application fees, examination fees, and fingerprinting fees. For a detailed breakdown of fees, please refer to the Florida Department of Insurance’s website.