Which of the following companies is using a divesting strategy – An exploration into the realm of corporate divestment strategies, this discourse delves into the intricacies of divesting, examining its motivations, advantages, and potential pitfalls. By investigating real-world examples of companies that have employed divesting strategies, we gain valuable insights into the complexities of this corporate maneuver.

Divesting, a strategic decision involving the sale or disposal of assets or business units, has emerged as a prevalent practice among corporations seeking to streamline operations, optimize portfolios, and adapt to evolving market dynamics. This discourse will provide a comprehensive overview of divesting strategies, highlighting their applications and implications within the corporate landscape.

Overview of Divesting Strategy

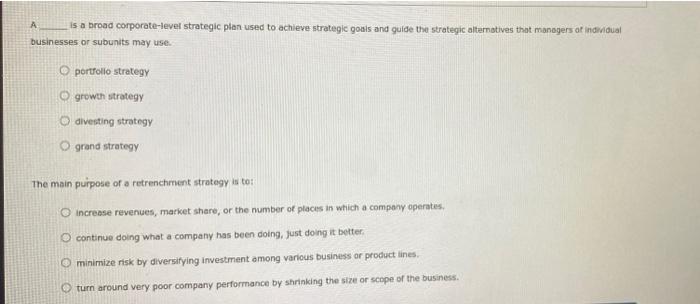

A divesting strategy involves the sale or disposal of a subsidiary, division, or business unit that is no longer considered core to a company’s operations or strategic direction.

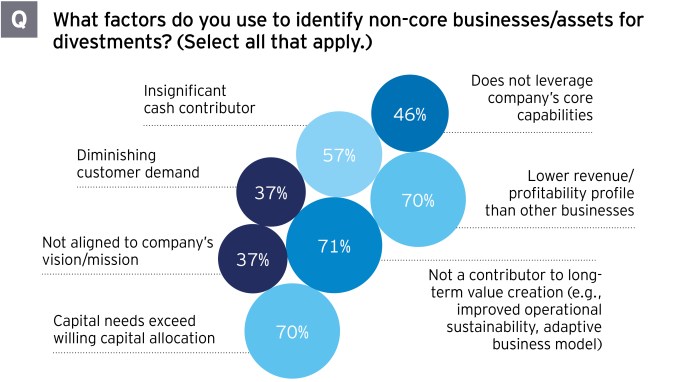

Key elements of a divesting strategy include identifying non-core assets, assessing the value of those assets, and finding suitable buyers or investors.

Examples of Companies Using Divesting Strategy, Which of the following companies is using a divesting strategy

| Company | Industry | Assets Divested | Year of Divestment |

|---|---|---|---|

| General Electric | Conglomerate | NBCUniversal | 2013 |

| AT&T | Telecommunications | WarnerMedia | 2022 |

| Johnson & Johnson | Healthcare | Consumer Health Business | 2023 |

| IBM | Technology | Managed Infrastructure Services | 2021 |

Reasons for Divesting: Which Of The Following Companies Is Using A Divesting Strategy

Companies may choose to divest for various reasons, including:

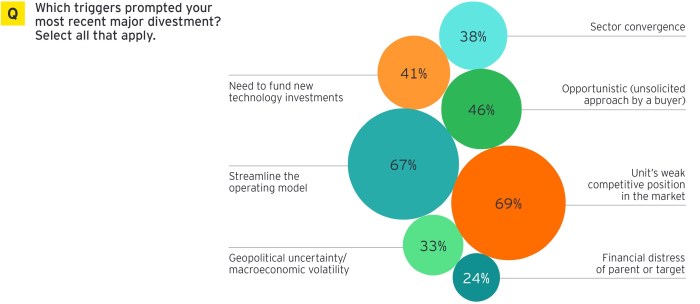

- Financial restructuring: Divesting non-core assets can generate cash and reduce debt, improving financial flexibility.

- Portfolio optimization: Divesting businesses that no longer align with a company’s strategic priorities allows it to focus on core operations.

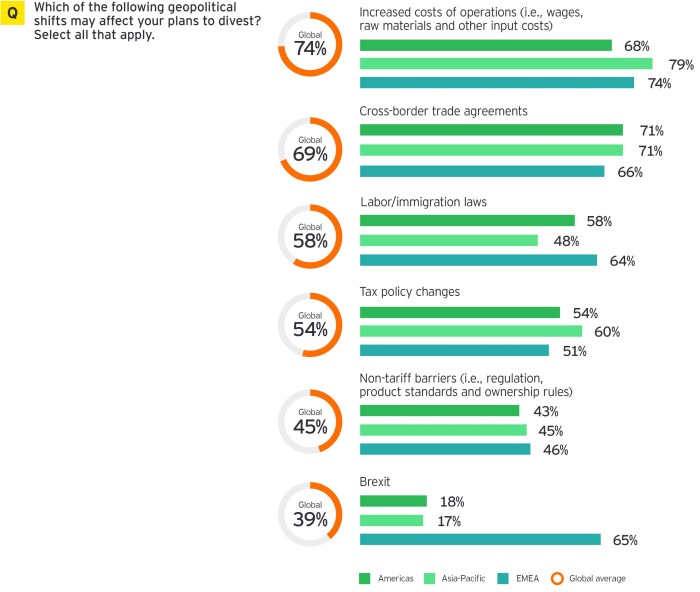

- Market changes: Divesting assets that are facing competitive pressures or technological disruption can help a company mitigate risks.

Benefits of Divesting

Divesting can offer several benefits, such as:

- Improved financial performance: Divesting non-performing assets can reduce costs and improve profitability.

- Enhanced focus on core business: Divesting distractions allows a company to dedicate resources to its core competencies.

- Increased agility and flexibility: Divesting non-core assets can make a company more agile and responsive to market changes.

Challenges of Divesting

Divesting also poses potential challenges, including:

- Transaction costs: Divesting involves transaction fees, legal expenses, and other associated costs.

- Loss of revenue or market share: Divesting assets can result in a loss of revenue or market share if the assets were significant contributors.

- Negative impact on employee morale: Divesting can lead to layoffs or reassignments, which can negatively impact employee morale.

Best Practices for Divesting

- Plan thoroughly: Conduct due diligence, assess risks and benefits, and develop a detailed plan.

- Communicate effectively: Inform stakeholders, including employees, investors, and customers, about the divestment and its rationale.

- Execute efficiently: Manage the transaction process smoothly and minimize disruptions to operations.

- Integrate post-divestment: Ensure a smooth transition and integration for both the divested business and the retaining company.

FAQ Overview

What are the primary reasons for companies to divest?

Companies may choose to divest for various reasons, including financial restructuring, portfolio optimization, market changes, and the need to focus on core competencies.

What are the potential benefits of divesting?

Divesting can lead to improved financial performance, enhanced focus on core business, increased agility, and greater flexibility in responding to market changes.

What are the challenges associated with divesting?

Divesting can involve transaction costs, loss of revenue or market share, and potential negative impacts on employee morale.