Embark on an enlightening journey with McGraw Hill Financial Accounting Chapter 1 Answers, a comprehensive guide that deciphers the intricacies of financial accounting, empowering you with the knowledge to navigate the complexities of the business world.

Delving into the fundamental concepts and principles that underpin financial accounting, this chapter lays the groundwork for understanding the language of business. Explore the role of GAAP, unravel the secrets of financial statements, and master the art of financial statement analysis.

McGraw Hill Financial Accounting Chapter 1 Overview: Mcgraw Hill Financial Accounting Chapter 1 Answers

Chapter 1 of McGraw Hill Financial Accounting provides a comprehensive introduction to the fundamental concepts and principles of financial accounting. It establishes the structure and organization of the chapter, outlining the key concepts covered and the learning objectives for students.

The chapter begins by defining financial accounting and explaining its purpose and importance in providing financial information to users. It emphasizes the role of Generally Accepted Accounting Principles (GAAP) in ensuring the reliability and consistency of financial reporting.

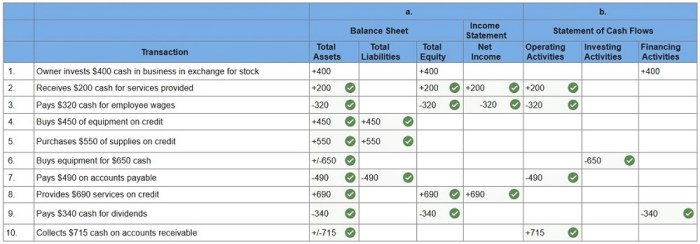

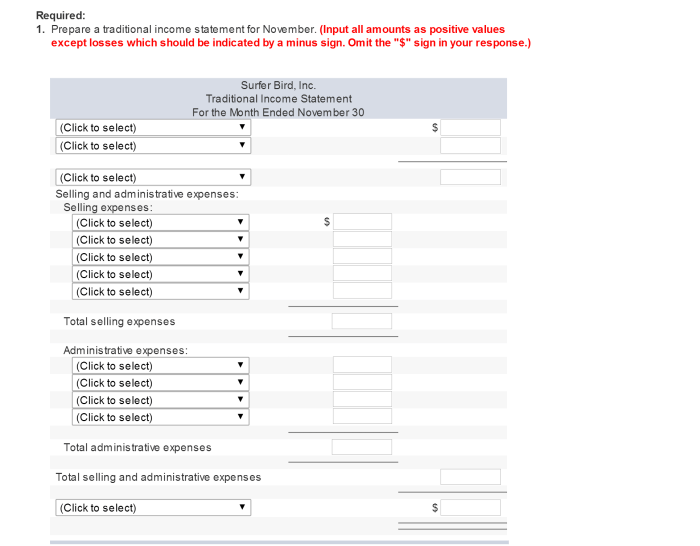

Chapter 1 also introduces the different types of financial statements and their respective purposes. These include the balance sheet, income statement, statement of cash flows, and statement of retained earnings. Students learn about the components of each statement and how they are interconnected.

Financial Accounting Concepts and Principles

Chapter 1 delves into the fundamental concepts of financial accounting, establishing a solid foundation for understanding the subject matter. It defines key terms such as assets, liabilities, equity, revenue, and expenses, and explains their significance in financial reporting.

The chapter emphasizes the importance of Generally Accepted Accounting Principles (GAAP) in guiding accountants in the preparation of financial statements. GAAP ensures that financial information is presented fairly and consistently, allowing users to make informed decisions.

Types of Financial Statements

- Balance Sheet: Provides a snapshot of a company’s financial position at a specific point in time, showing its assets, liabilities, and equity.

- Income Statement: Summarizes a company’s revenues and expenses over a period of time, resulting in net income or loss.

- Statement of Cash Flows: Shows the sources and uses of cash during a period of time, categorized into operating, investing, and financing activities.

- Statement of Retained Earnings: Reconciles the beginning and ending retained earnings balance, explaining changes due to net income, dividends, and other transactions.

The Accounting Equation

Chapter 1 introduces the fundamental accounting equation: Assets = Liabilities + Equity. This equation forms the basis for understanding how financial transactions are recorded and reported in financial statements.

Students learn how to use the accounting equation to analyze business transactions and determine their impact on the financial position of a company. They also gain an understanding of double-entry bookkeeping, which ensures that every transaction is recorded with equal debits and credits.

Recording Business Transactions

- Debit: Increases assets or expenses; decreases liabilities, equity, or revenue.

- Credit: Increases liabilities, equity, or revenue; decreases assets or expenses.

Financial Statement Analysis

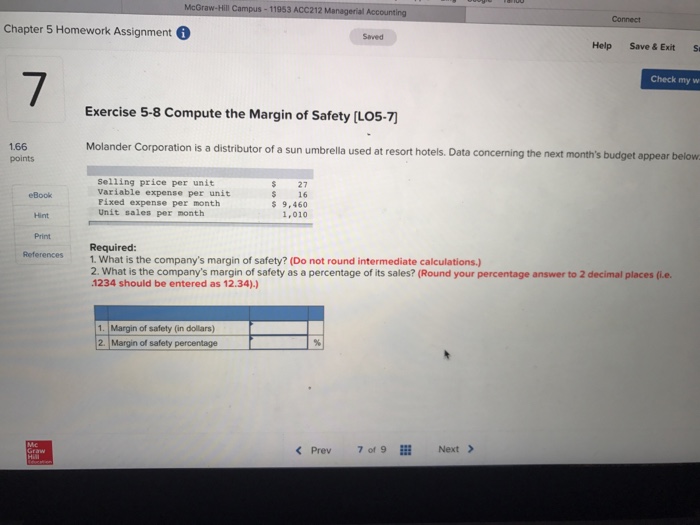

Chapter 1 highlights the importance of financial statement analysis in assessing a company’s financial performance and making informed decisions. Students are introduced to key financial ratios, such as liquidity ratios, profitability ratios, and solvency ratios, and learn how to calculate and interpret these ratios.

The chapter emphasizes the role of financial statement analysis in identifying trends, evaluating management’s performance, and making informed investment decisions.

Key Financial Ratios

- Current Ratio: Measures a company’s ability to meet its short-term obligations.

- Gross Profit Margin: Indicates the percentage of revenue left after deducting the cost of goods sold.

- Debt-to-Equity Ratio: Assesses a company’s financial leverage and risk.

Ethical Considerations in Financial Accounting

Chapter 1 concludes by discussing the ethical responsibilities of accountants and the importance of integrity and objectivity in financial reporting. Students learn about the ethical principles that guide accountants and the consequences of unethical behavior.

The chapter emphasizes the role of accountants in ensuring the accuracy and reliability of financial information and the importance of maintaining public trust in the accounting profession.

Consequences of Unethical Behavior, Mcgraw hill financial accounting chapter 1 answers

- Loss of reputation and credibility

- Legal penalties and fines

- Damage to the accounting profession

Query Resolution

What is the accounting equation?

The accounting equation is a fundamental formula that expresses the relationship between assets, liabilities, and equity: Assets = Liabilities + Equity.

What are the different types of financial statements?

The three main types of financial statements are the balance sheet, income statement, and statement of cash flows.

What is the purpose of financial statement analysis?

Financial statement analysis helps users assess a company’s financial performance, solvency, and liquidity.