A columnar accounting form used to summarize – Columnar accounting forms, indispensable tools in the realm of accounting, offer a structured and efficient approach to summarizing data. Their versatility extends to a wide range of applications, making them a cornerstone of accurate and timely financial reporting.

By organizing data into vertical columns, columnar accounting forms facilitate the comparison and analysis of different categories, providing a comprehensive overview of financial transactions. Their use enhances efficiency, minimizes errors, and supports informed decision-making.

Columnar Accounting Forms

Columnar accounting forms are a type of accounting worksheet that is used to summarize data. They are typically used in situations where there is a large amount of data that needs to be organized and summarized in a way that makes it easy to understand and analyze.

Columnar accounting forms are typically used in the following situations:

- To summarize financial data, such as income and expenses

- To summarize non-financial data, such as sales data or production data

- To compare data from different periods or different entities

- To analyze data to identify trends or patterns

Advantages of Using Columnar Accounting Forms

There are several advantages to using columnar accounting forms, including:

- They help to organize data in a way that makes it easy to understand and analyze.

- They can be used to summarize large amounts of data in a relatively small space.

- They can be used to compare data from different periods or different entities.

- They can be used to analyze data to identify trends or patterns.

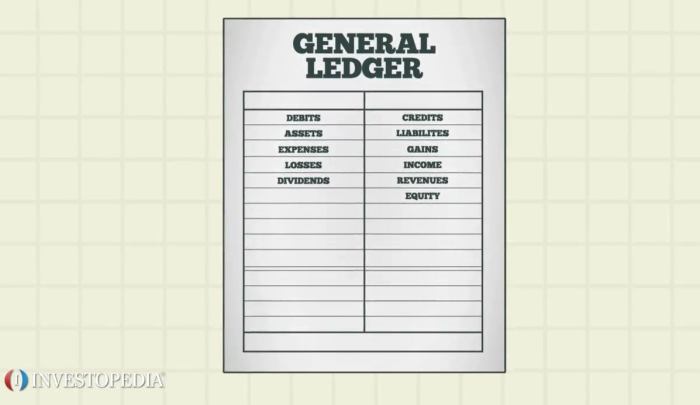

Types of Columnar Accounting Forms, A columnar accounting form used to summarize

There are several different types of columnar accounting forms, including:

- Single-column forms: These forms have a single column for each type of data that is being summarized.

- Multi-column forms: These forms have multiple columns for each type of data that is being summarized.

- Comparative forms: These forms have columns for data from different periods or different entities.

- Analytical forms: These forms have columns for data that has been analyzed to identify trends or patterns.

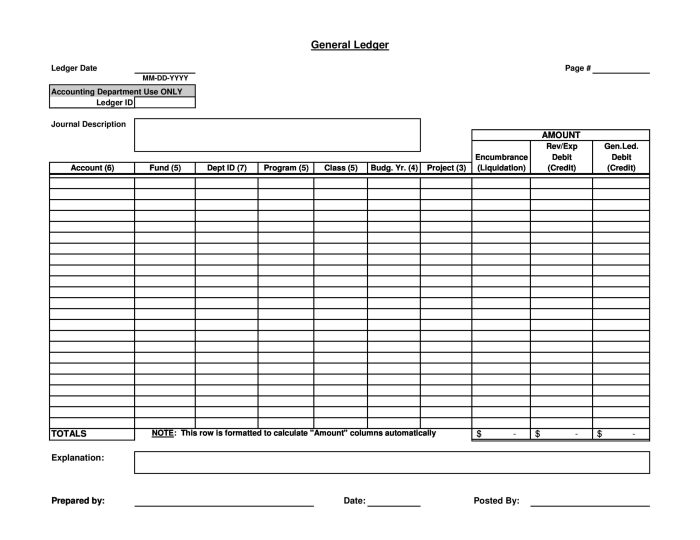

Designing a Columnar Accounting Form

When designing a columnar accounting form, it is important to consider the following factors:

- The purpose of the form

- The type of data that will be summarized

- The number of columns that are needed

- The headings that will be used for each column

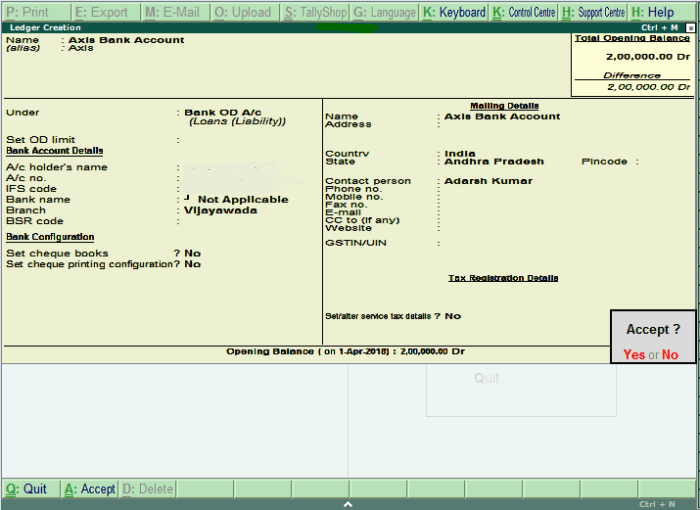

Using Columnar Accounting Forms in Practice

Columnar accounting forms are used in a variety of accounting applications, including:

- Financial accounting

- Management accounting

- Cost accounting

- Auditing

Advanced Applications of Columnar Accounting Forms

Columnar accounting forms can be used for a variety of advanced applications, including:

- Statistical analysis

- Financial modeling

- Decision-making

FAQ: A Columnar Accounting Form Used To Summarize

What are the key advantages of using columnar accounting forms?

Columnar accounting forms offer numerous advantages, including improved efficiency, enhanced accuracy, simplified data analysis, and better decision-making capabilities.

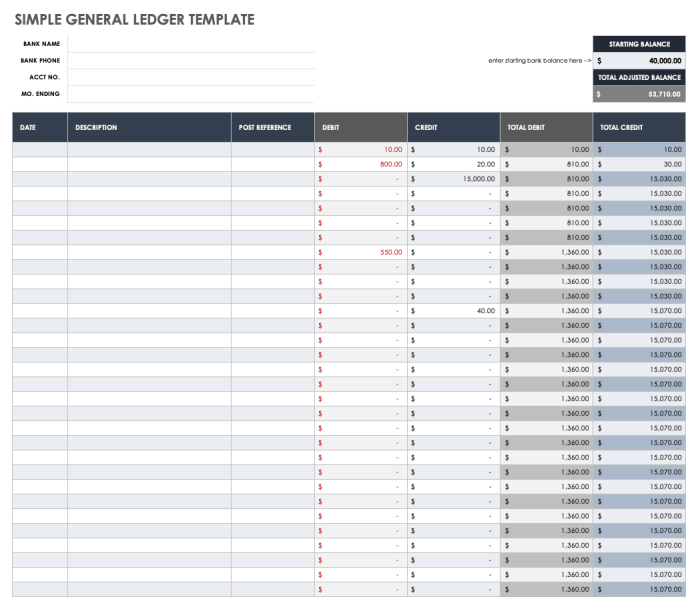

How are columnar accounting forms used in practice?

Columnar accounting forms find application in various accounting tasks, such as summarizing transactions, preparing financial statements, and analyzing financial data.